How to determine your trading budget

- Author Anselme Nkondog

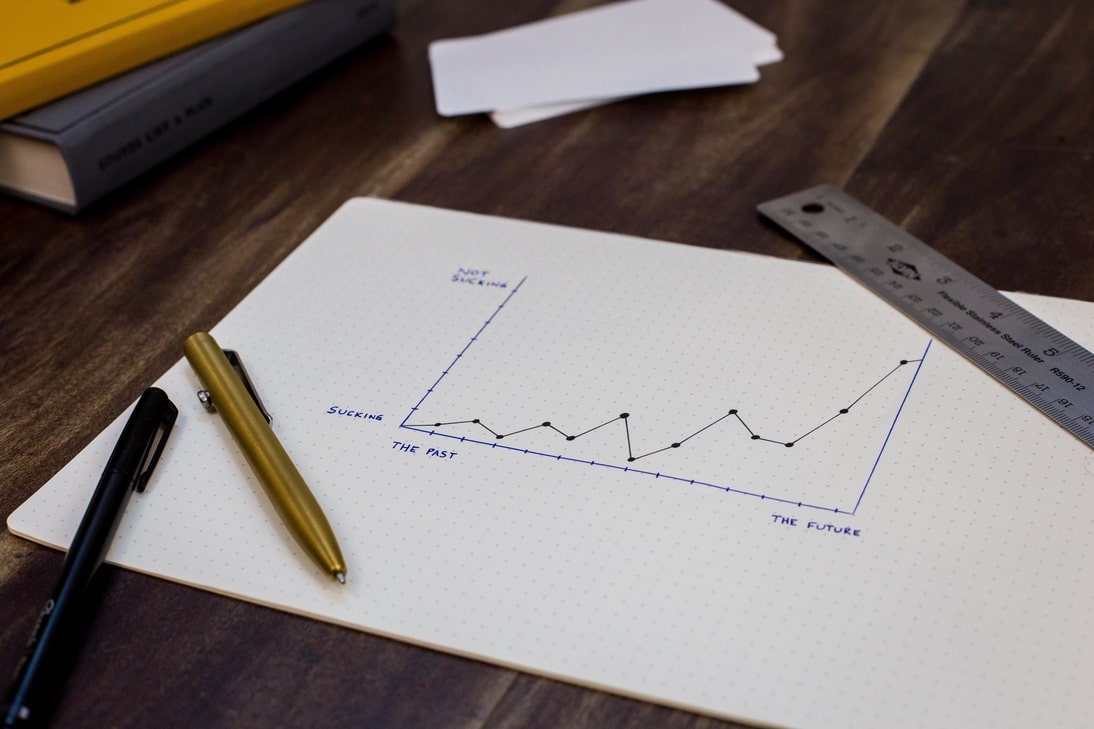

Many embark on trading with the hope of making a quick fortune. But the truth is cold to swallow because more than 90% of novices will ruin themselves. This is due to several factors. The idea that many have on trading is the first cause of their loss. Trading is a professional activity that must be managed like a real business; and who says business says PLAN, and BUDGET.

To get started in trading, especially in the learning phase, you can start with demo accounts (which Salix nigra does not recommend). Instead, we recommend opening real accounts with small amounts. This allows you to feel the real effects of trading. When you feel comfortable with your strategy, you can move on to the next step.

Becoming an independent trader is certainly not an easy thing to do, and so does not. The first thing to consider before you start trading full time is the mastery of your trading strategy. You must know what to expect from your strategy and it is based on your strategy that you will define your initial budget.

Before deciding to jump into the water, there are things to consider:

- - Profitability of your strategy

- - Your monthly needs and expenses

Take the example of Joe. Joe started trading a while ago. He followed our training and has a profitable trading strategy. Over the last 5 years, Joe has returned 36% on average. So Joe's profitability is 36%.

Joe is a young single man who has a small studio and some expenses to manage. On average, Joe spends 90,000 FCFA / month. However, since trading is a business, you have to think like a businessman. In addition to being able to pay for your expenses, you need to make profits that you reinvest to grow your investment fund.

I recommend you add 30% of your expenses as an amount to reinvest in your business. We will call this reinvestment amount.

For Joe to be an accomplished independent trader, he needs the proper budget. If Joe makes 36% / year, it means that he generates an average of 3% / month.

Joe's total expenditure is 90,000 + (90,000 x 30%) or 117,000 FCFA

Joe can generate validly 3% per month in theory. So Joe needs 3,900,000 FCFA as initial capital. I begin to feel the hearts beating, disappointments in the air. You understand that trading is not for everyone. To make money in trading, you must first have money. It's the sad truth.

Speaking of reality, we have made theoretical estimates that are certainly valid but the reality is slightly different. As an independent trader, you will have months of loss. How are you going to do it? You will also have months of earnings. You have to manage trading as a real business.

You want to get into trading maybe because you've read somewhere that you can get rich overnight by trading, it's easy, etc ... Well, the truth is bitter and hard to swallow.

Trading as your main business takes a lot of time and mastering of a trading strategy that is profitable for you. Your trading has to be treated like a business and you have to be able to survive and manage the difficult months. 90% of traders do not see trading as a business, rather than a passing bet, and those are losing their money.

From the beginning, approach trading as a serious activity, as a business, have a trading plan. If you want to give up all to do trading just because you have watched a motivational video about wealth, rest assured that you have read and understood this article and that in the end you you feel confident. Otherwise, I advise you to keep your job and do trading to learn or as an additional source of income, not at 100%.

It's great to live with trading, Salix Nigra is here to support you and help you avoid the mistakes of beginners.